Breathtaking Info About How To Reduce Taxes On Your Social Security Benefits

How can i have income taxes withheld from my social security benefits?

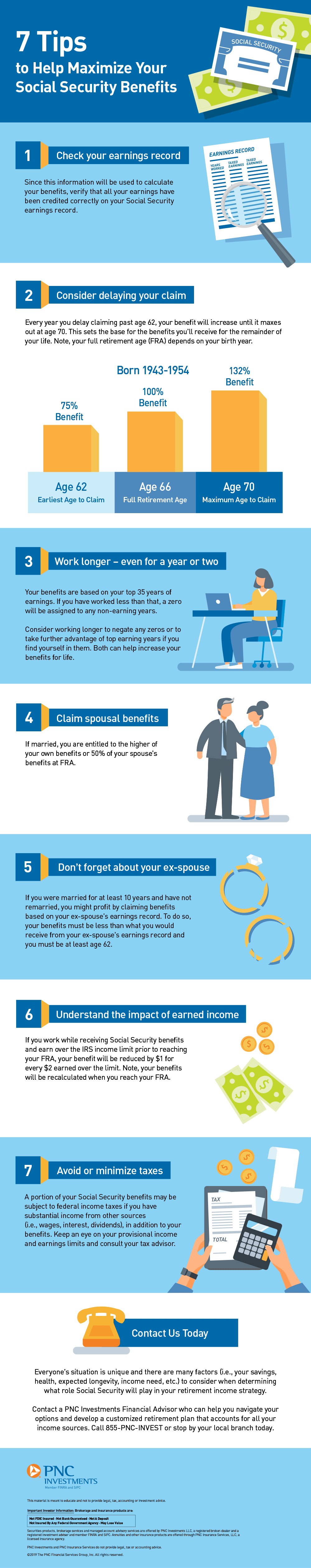

How to reduce taxes on your social security benefits. 3 ways to avoid taxes on benefits place some retirement income in roth accounts. How to minimize taxes on your social security 1. To determine the percentage that.

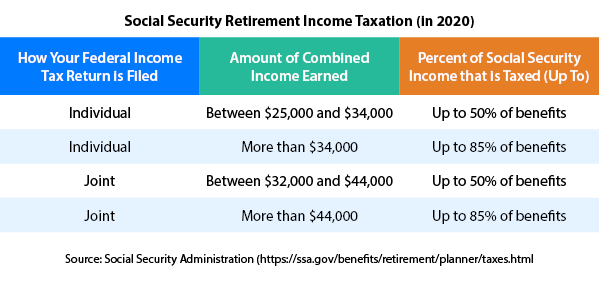

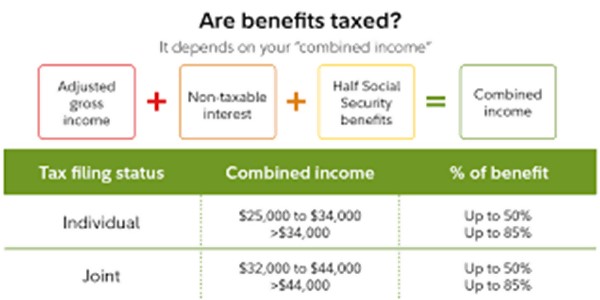

A provisional income between $32,000 and $44,000 could mean taxes on up to 50% of benefits, and beyond. 7 once you reach full. 151389 if you get social security, you can ask us to withhold funds from your.

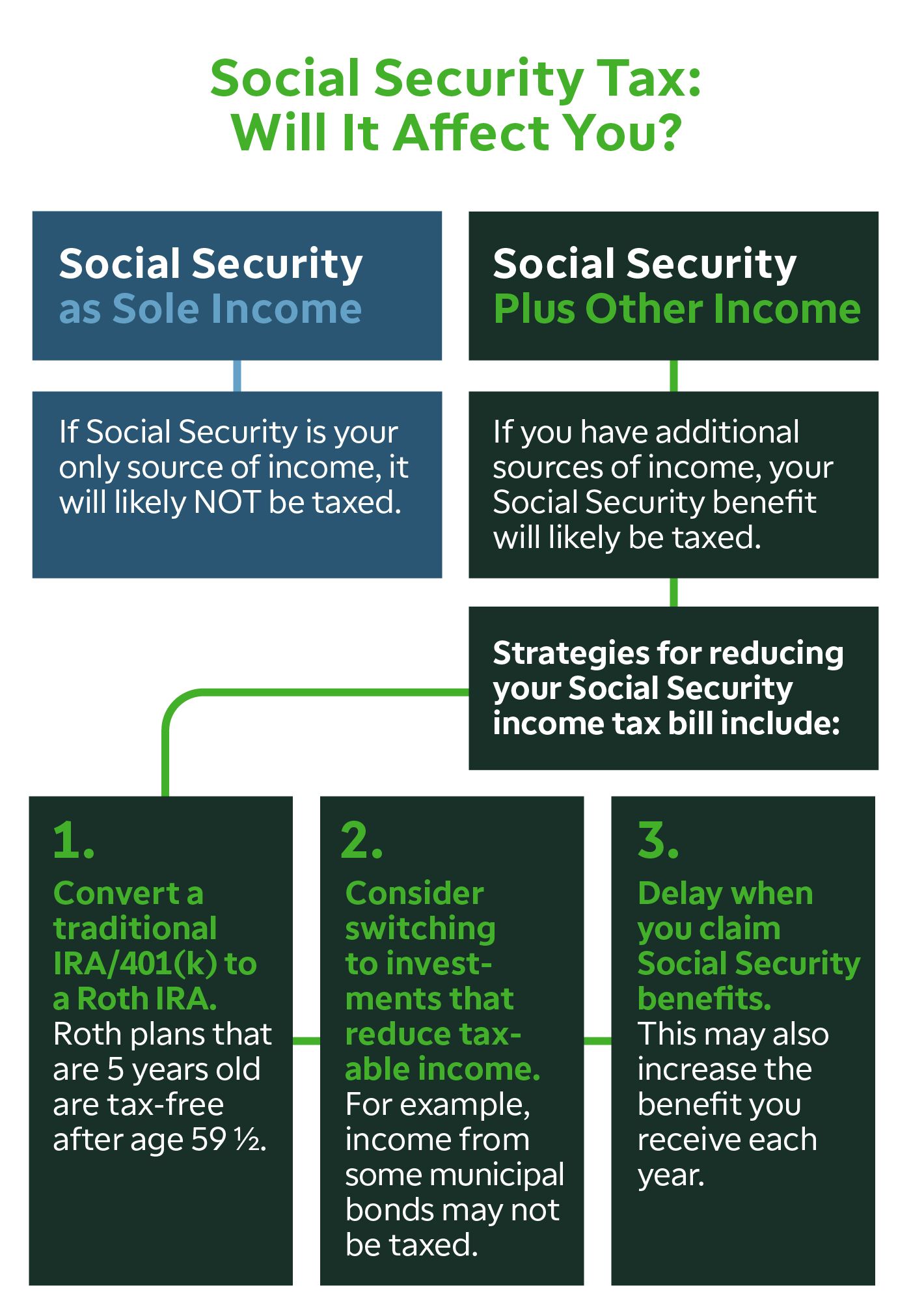

As you can see from the formula, the main ways to reduce your combined income would be to reduce your nontaxable interest or reduce your agi. Rolling over money from a traditional ira or 401 (k) to a roth years before you start receiving social security benefits is a good way to avoid taxes later in retirement. These thresholds are higher for married couples filing jointly.

One way to lower your tax bill is to opt for a qualified charitable distribution, or qcd, which lets you give your required minimum distributions to charity. Ways to reduce or eliminate social security tax first, let's address the roth ira. Social security benefits — yours, your parents or an elderly relative's, let's say — can be subject to income tax.

But you can take steps to minimize. Most retirees are looking to pull money from their iras rather than put it. We use the following earnings limits to reduce your benefits:

See these tips on how to reduce those potential taxes. (if you are deaf or hard of hearing, call the irs tty number, 1. How to reduce or eliminate taxes on social security benefits!

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

/GettyImages-1134937342-4f983d6e2462466b902206a0525d82b3.jpg)